Email Delivery Specialist + Email List Manager + Email Copywriter

Chris Sewell

Below are long-form writing samples to demonstrate my writing style.

My style can fit shorter email copy to generate lead calls from your email list.

My specialty is making you more money through email.

I do this in 3 ways:

Long-Form Writing Samples

LinkedIn Post Article samples

A LinkedIn post demonstrates your knowledge of cyber threats faced by your target audience. It can also be used to outline your firm's unique solution to combating threats.

Hospitals and Healthcare Organizations Must Prioritize Cybersecurity to Stay Competitive

It is crucial for hospitals and healthcare organizations to pay more attention to cybersecurity. The recent Colonial Pipeline ransomware attack resulted in fuel shortages and increased gas prices, which indicates the devastating and extensive impact of cyberattacks on critical infrastructure.

The American public and the government are now more aware of the severity of cyber incidents, such as SolarWinds, JBS, and Kaseya. As a result, the government has taken various actions, including appointing the first-ever National Cyber Director, attributing the SolarWinds attack to Russia, releasing an executive order for new security standards for software on federal procurement lists, and proposing legislative measures to improve the nation's cybersecurity.

Policymakers Not Prioritizing Cyber Crime

Despite the fact that cyber incidents have prompted many cybersecurity initiatives, policymakers have not given enough attention to the significant cyber risks that exist in the healthcare industry. The WannaCry ransomware attack that disrupted the United Kingdom's National Health Service in 2017 was a wake-up call to healthcare organizations globally, highlighting the pressing need for proactive investments in cybersecurity.

Despite this, healthcare organizations in the United States continue to be an easy target, as they are falling behind other industries in terms of cyber-readiness.

COVID-19 Plays a Role

The recent spike in COVID-19 cases has led to hospitals being overwhelmed, highlighting the importance of having a strong healthcare system in times of crisis. Unfortunately, the pandemic has also seen a rise in ransomware attacks on healthcare organizations.

Even more concerning, there was a reported death in 2020 as a result of a ransomware attack. This shows that hackers can infiltrate important healthcare infrastructure, such as refrigerators that store blood products and CT scans that are essential for treating trauma patients.

The Cybersecurity and Infrastructure Security Agency, the FBI, and the Department of Health and Human Services (HHS) have issued a joint advisory warning about the recent rise in cyberattacks on healthcare organizations. This poses a significant threat to US hospitals and healthcare providers. Moreover, with the Delta variant causing a surge in patients, hospitals are once again reaching their maximum capacity, making cybersecurity more crucial than ever.

The Concerning State of Healthcare Cybersecurity

Back in 2017, the Health Care Industry Cybersecurity (HCIC) Task Force informed Congress that healthcare cybersecurity was in a precarious state, and four years down the line, their statement still holds ground. With the COVID-19 pandemic, ransomware attacks have surged across all sectors, but sadly, healthcare has borne the brunt of these attacks more than any other industry.

According to the 2020 HIMSS Cybersecurity Survey, a whopping 70% of hospitals that were surveyed reported experiencing a major security issue in the last year. These issues included phishing and ransomware attacks, which caused disruptions to IT operations and business functions for 28% and 25% of the hospitals, respectively. Additionally, 21% of hospitals experienced data breaches, and 20% reported financial losses due to these incidents.

Healthcare Organizations Are East Targets

Healthcare organizations are a prime target for hackers who are after financial gain. They have a larger area to attack, which makes it easier for cybercriminals to find and exploit vulnerabilities. In 2009, the HITECH Act was passed to encourage health information technology investments to modernize the U.S. healthcare system.

This resulted in more connectivity and usage of medical devices, with Electronic Health Record systems becoming the core of healthcare organizations. These systems connect medical devices with other applications to provide a more complete picture of patient health.

In the United States, hospitals have around 10 to 15 medical devices connected to their network for every bed. This means that larger healthcare facilities are faced with the challenging task of securing tens of thousands of devices, which are often vulnerable to hacking.

The advancement of technology in healthcare has improved patient care, but it has also opened up opportunities for cyberattacks. If even one device is vulnerable, it can give hackers access to confidential patient information and medical services, putting data integrity and availability at risk.

If you would like more information about how our firm protects hospital data, contact us at xxx-xxx-xxxx or email us at xxx@company.com

Protecting Financial Service Firms From Cyberattacks that Might Cost the Firm Millions in Fines

In recent years, the financial sector has faced an increasing number of cybersecurity threats. Compared to other industries, financial services organizations are at a higher risk of experiencing cyberattacks, with a likelihood that is 300 times greater.

Because the banking sector is so interconnected, if one of the top five US banks experiences an attack, it can impact 38% of the entire network. Given the rise in cyber security threats, banks and financial institutions need to take a proactive approach and invest in building up their cyber resilience.

To safeguard the financial sector against cybersecurity threats and improve cyber resilience, it is important to adhere to certain best practices. In this regard, it is crucial to be fully aware of the nature and severity of such threats.

A Snapshot of Cybersecurity Threats to Financial Service Firms

Cybercriminals have always had their eyes on financial services organizations, but these organizations are even more susceptible to attacks nowadays. Want to know why? Keep reading.

Financial institutions and banks have always been attractive targets for cybercriminals due to their substantial financial assets and valuable data resources. However, with the advent of digital transformation, these organizations are generating even more data that can be exploited by hackers. They can either use it themselves, sell it on the black market, or use it as leverage to demand a ransom.

Even though the financial services industry is trying to go digital, there are still a lot of old technologies and computer systems that can't be replaced right away because they contain important functions or data.

5 Critical Cybersecurity Threats Faced by Financial Service Firms:

One of the most important things for financial services organizations to keep in mind is how to protect themselves from cyberattacks. There are several ways to do this, and it's crucial not to leave out any important methods.

By taking the necessary steps to safeguard against cyberattacks, your organization can reduce the risk of a devastating breach of security.

1. Implement a Formal Security Framework

It's crucial for financial services companies to make sure they follow the rules and regulations related to their operations. To help manage their cybersecurity risks and meet compliance requirements, there are different security frameworks available.

Some examples include the NIST Cybersecurity Framework and the FFIEC Information Technology Examination Handbook. It's important to keep in mind that while these frameworks can help lay a strong foundation for security, they can't guarantee complete protection against cybersecurity threats in the financial industry.

2. Establish a Comprehensive Cyber Risk Management Strategy

When it comes to risk management, financial service companies should be proactive and thorough. It's important to take a holistic approach to cyber risk management, considering factors like people, processes, technology, and third-party involvement. Instead of just focusing on one area, a well-rounded strategy is key.

3. Perform Intelligent Threat Monitoring Continuously

It's possible for attackers to sneak into financial networks and cause serious damage without being detected for a long time. To prevent cyber threats in the financial sector, it's important to be proactive. This means having real-time monitoring that can detect and respond to threats quickly. All network activities, user behavior, traffic patterns, and more should be constantly monitored.

To make security more effective, modern technologies like self-learning AI, automation, analytics, and cloud computing should be used. These tools can improve security by making it more agile and accurate, which reduces guesswork and helps you stay ahead of potential attackers.

4. Implement Vulnerability Management Processes

When it comes to cybersecurity threats to the financial sector, leaving any security gaps can provide an open invitation to attackers. That's why it's important to have strong vulnerability management processes in place.

These processes can help you identify and fix any security weaknesses, vulnerabilities, or misconfigurations before hackers have a chance to exploit them. With around-the-clock visibility into your security posture, you can keep strengthening your defenses to stay ahead of potential threats.

5. Consider Third-Party Risks

One of the biggest dangers to the financial services industry is unsecured third-party services. Therefore, it is crucial to have a security plan that includes managing the risks associated with third-party providers. It is important to thoroughly screen and evaluate potential partners, vendors, and service providers before bringing them on board.

Additionally, it is essential to continuously monitor your network to detect any threats that may originate from their networks or devices. Tightening access controls is another important step to take. Finally, it's vital to conduct periodic security audits to ensure that they are compliant with regulations and have a strong security posture.

6. Create a Cybersecurity Culture Within the Company

It's important to make sure everyone understands the importance of security and doesn't just leave it to the IT department. The support of top management is crucial since they can allocate enough resources to keep things secure. Also, their backing helps to get everyone on board with the security culture, creating more unity and understanding.

7. Establish a Robust Incident Response Plan

No matter how hard you try, your organization's security measures will eventually be put to the test. The key is to have solid plans in place for responding to incidents, so you can reduce the damage and recover quickly.

The financial sector is facing some serious cybersecurity threats that can cause harm, but they can be prevented if you take a proactive risk-based approach and implement strong security measures. So, have you taken any steps to secure your financial service organization? It's better to invest in security measures before it's too late.

If you would like more information about how our firm protects sensitive data, please contact us at xxx-xxx-xxxx or email us at xxx@company.com

Curated Article Post samples

A curated post is a great way to position your firm (or yourself) next to a notable source which gives you a credibility boost. This type of post allows you to summarize a topic written by an influential organization or thought-leader.

Summarizing "Cybersecurity Issues in Healthcare: Recent Trends and Solution"

I would like to summarize a piece written in securityboulevard.com called "Cybersecurity Issues in Healthcare: Recent Trends and Solution." You can read the full article here, but first, review my summary.

The healthcare industry faces significant cyber risks due to the sensitive patient data it holds and the critical services it provides. Healthcare is the 6th most attacked industry, with ransomware being a dominant cybersecurity issue.

Threat actors perceive healthcare providers as more likely to pay up, leading to double extortion tactics, and some gangs have even moved on to triple extortion. Account compromise is a growing problem due to the number of different applications and services that healthcare employees require access to, and this leads to potential data breaches.

What About Smaller Healthcare Providers?

Smaller healthcare providers are also being targeted due to weak cyber defenses and less media attention. Medical device security concerns pose headaches for technology executives at healthcare companies, with many relying on legacy devices that never had any security built into them.

Proposed solutions include the Healthcare Cybersecurity Act of 2022, which directs a collaborative effort between CISA and the U.S. Department of Health and Human Services to reduce cybersecurity attacks and data breaches in healthcare and public health.

The act also requires CISA to conduct a comprehensive study outlining key cybersecurity risks facing the healthcare sector, provide training to asset owners and operators on cybersecurity risks and ways to mitigate them, and assess healthcare cybersecurity workforce shortages.

In Comes the FDA

The FDA has released guidelines for cybersecurity in medical devices, with the aim of ensuring that cybersecurity is an integral part of device safety. The guidelines recommend achieving security by design and transparency for users, as well as scaling the required cybersecurity design and documentation based on the cybersecurity risks of a given device. Healthcare providers are advised to refer to these guidelines when procuring medical devices.

Zero trust architecture is recommended as a way to reduce the threat of account compromise and associated breaches of sensitive patient records, medical devices, and applications. This architecture removes any implicit trust given to users on the network and assumes a threat actor is always lurking, with access to resources dynamically and continually authenticated based on the identity and context of each request.

Outsourcing security operations is also recommended as a path worth exploring, particularly for smaller and midsize healthcare providers who may suffer from resource constraints that larger providers don’t suffer from as much. Managed providers use teams of experts to run their own security operations centers, fine-tune SIEM systems and monitor IT environments at scale.

I'm open to understanding your opinion regarding this topic. Reach out to me at xxx@xxxx.com

https://securityboulevard.com/2022/10/cybersecurity-issues-in-healthcare-recent-trends-and-solution/

Summarizing "Cybersecurity trends in 2023 – what Fintechs Can Expect."

I would like to summarize a piece written in FinTech Magazine called "Cybersecurity trends in 2023 – what Fintechs Can Expect." You can read the full article here, but first, review my summary.

Cybersecurity is not just a buzzword anymore. It's a serious concern that Fintechs need to address with utmost caution.

With cybercrime becoming more organized and sophisticated, it's essential to stay ahead of the game. The rise of Ransomware-as-a-Service, Hackers-as-a-Service, and Access-as-a-Service makes it even more challenging to protect sensitive data.

As a result, cybersecurity has become an integral part of any fintech's strategy. Human error remains the biggest vulnerability, making it critical to educate employees about cybersecurity best practices and invest in security measures to keep your business safe.

Being a Prime Target

When it comes to cybersecurity, financial institutions are a prime target for attackers. That's why it's crucial for them to take proactive measures to protect their data. Regular backups are an effective way to safeguard against data loss, especially in the event of a breach or ransomware attack. However, it's not just data breaches that pose a threat.

As software supply chains become more complex, identifying and resolving vulnerabilities is becoming increasingly challenging. It's vital for financial institutions to stay vigilant and invest in the latest security solutions to keep their systems safe.

Finding Talent Isn't Easy

Financial institutions are central targets for cybercriminals due to the sensitive nature of their data. The lack of available cybersecurity talent has made it increasingly difficult for these institutions to manage their security needs in-house. However, upskilling current staff has become a crucial solution to this problem.

Implementing zero-trust models can be an effective alternative to password protection, and it can save financial institutions up to 43% on data breach costs. AI is also being used to help keep data safe by tracking suspicious activity and alerting organizations in real time, giving them a fighting chance against cyber attacks.

I'm open to understanding your opinion regarding this topic. Reach out to me at xxx@xxxx.com

FinTech Magazine:

https://fintechmagazine.com/financial-services-finserv/cybersecurity-trends-in-2023-what-fintechs-can-expect

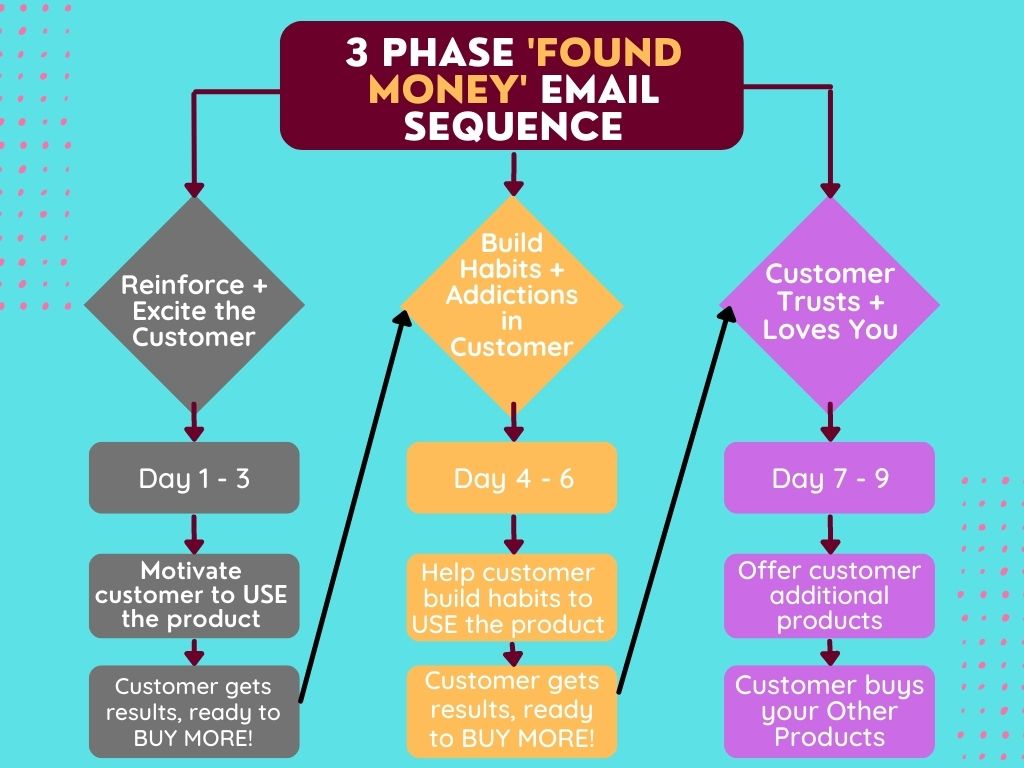

My '3 Phase Found Money' Formula

This is what makes me different than any copywriter you have ever met or will ever met.

I developed a '3 Phase Found Money' Email Sequence to help you raise your customer Lifetime Value (LTV).

I called this 'Found Money' because this cash is sitting in your list, waiting for you to extract it.

Once I get your new customer to USE what they purchased from you, they get the promised result and are now ready to BUY MORE from you.

This process map shows you how my system works.

Copyright © Chris Sewell Digital Media LLC. All Rights Reserved.